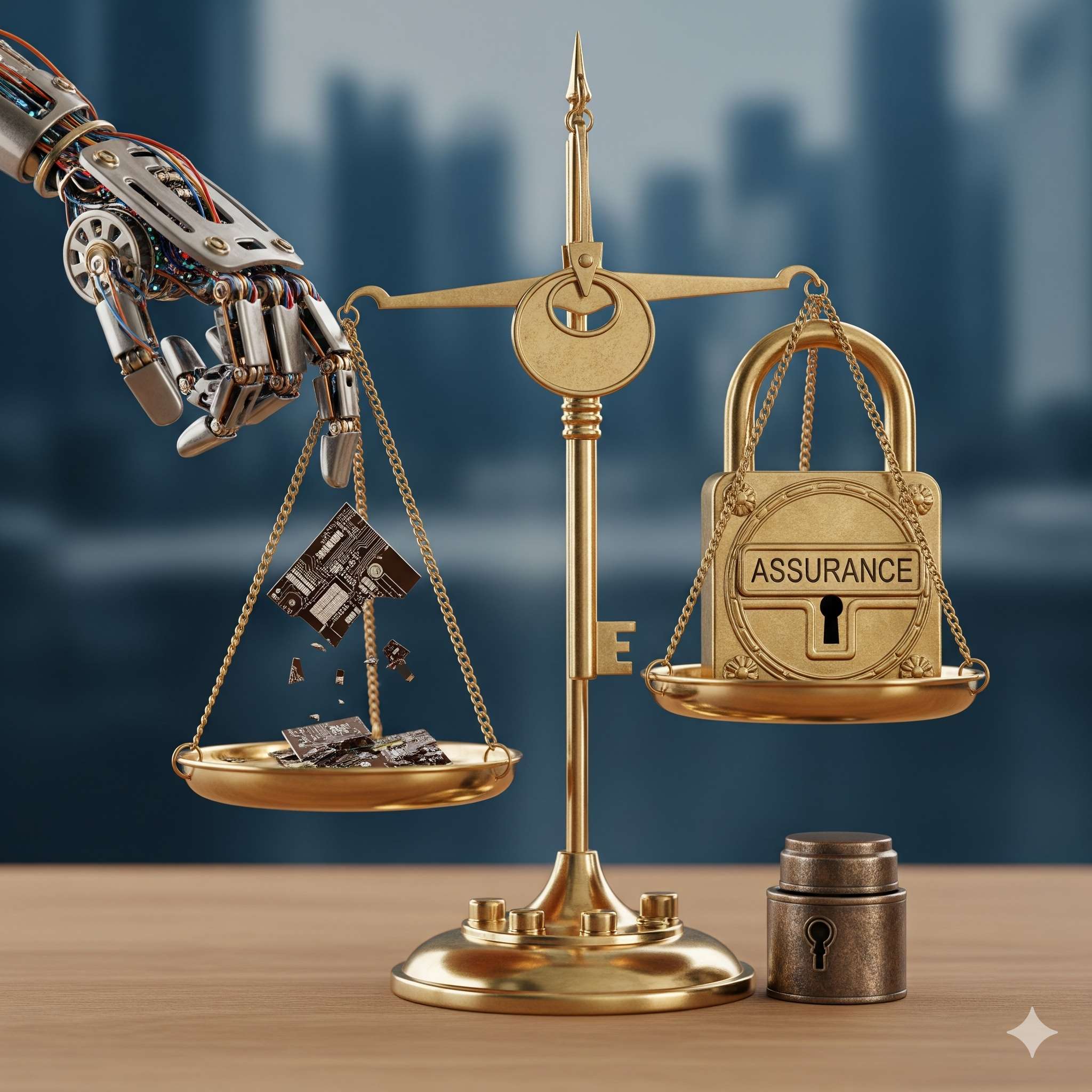

Cyber vs. AI Liability: What's Actually Covered?

Most businesses already carry cyber liability insurance. But does it cover the new risks from AI and large language models? The short answer: not always.

What cyber liability usually covers

- Data breaches (hacks, ransomware, lost devices)

- Breach notification costs

- Business interruption due to cyberattacks

- Regulatory fines for data protection failures

AI-specific risks not always covered

- Hallucinated content – AI gives wrong advice (medical, legal, financial) → lawsuit risk.

- Prompt injection attacks – Malicious users trick AI into leaking or altering data.

- Bias/discrimination – Especially in HR and recruiting, healthcare applications, or financial services.

- Vendor chain issues – Using a non-compliant third-party AI vendor may fall outside coverage.

Gray zones and disputes

Even when policies reference "cyber incidents," insurers may argue that an AI error isn't a cyber event. Without clear definitions, claims may be denied.

What to ask your insurer

- Does my cyber policy cover AI/LLM-related incidents explicitly?

- Is there an endorsement available for AI-specific risks?

- Would hallucination-caused harm count as a "covered event"?

- How does the policy treat vendor AI tools and subcontractors?

For a complete list of questions, see our 5 questions to ask your insurer about AI risk.

Download: Cyber vs. AI Risk Checklist (free)

No email required — direct download available.

Before you talk to your insurer about AI...

Run the Free 10-Minute AI Preflight Check to identify coverage gaps and liability blind spots. Then use the insights to have more productive conversations with your insurance team.

2-page PDF with fillable checkboxes • No email required